49+ can you write off interest paid on your mortgage

However if your property operates as a short-term rental you may only claim a portion of the interest paid on the home. Web In 2021 you took out a 100000 home mortgage loan payable over.

49 Sample Monthly Budgets In Pdf Ms Word

Web As well changes came into effect on Dec 15 2017 that lowers the amount a deduction can be claimed on.

. Single or married filing separately 12550. Web Yes your deduction is generally limited if all mortgages used to buy construct or improve your first home and second home if applicable total more than 1 million 500000 if you use married filing separately status for tax years prior to 2018. You may still be able to deduct the interest on your personal portion of the mortgage on your Schedule A.

Web For 2021 tax returns the government has raised the standard deduction to. If you put down less than 20 of the purchase price for your. 1 reducing income and increasing deductions 2 deducting the interest you.

The Tax Cuts and Jobs Act TCJA which is in effect from 2018 to 2025 allows homeowners to deduct interest on home loans up to. Citizens or resident aliens for the entire tax. Web Most homeowners can deduct all of their mortgage interest.

Web Claiming your mortgage interest can be an effective way to reduce your income and increase your deductions. Web You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to buy the property or to improve it. Today homeowners can deduct interest on a mortgage valued up to 750000 or 375000 if spouses are filing separately.

Create Your Satisfaction of Mortgage. The benefits of claiming your mortgage interest include. Web 2 hours agoKey points.

However you can only deduct the interest that you paid during that year. You see in the US mortgage interest is considered tax-deductible. The Commonwealth Bank Australias biggest home lender has increased its one.

At least in most circumstances you can. Web This can save you a lot of money on your tax bill. This means when you file your taxes and have to pay a certain sum each year you can deduct the cost of your.

Only 35 of those surveyed by Northwestern Mutual in 2022 have worked with a finance professional. You can write off the interest you pay on up to 1000000 of mortgage debt on your home or second home as long as you took out the mortgage to. Web As of the beginning of 2018 couples who file their taxes jointly are only able to deduct interest on up to 750000 of eligible mortgages which is down from 1 million the year before.

For example you might pay 1000 in interest on your mortgage loan during the 2021 tax. Web The interest portion of your monthly mortgage payment isnt the only type of interest youre permitted to deduct from your annual tax bill. Web Can You Write Off Mortgage Interest.

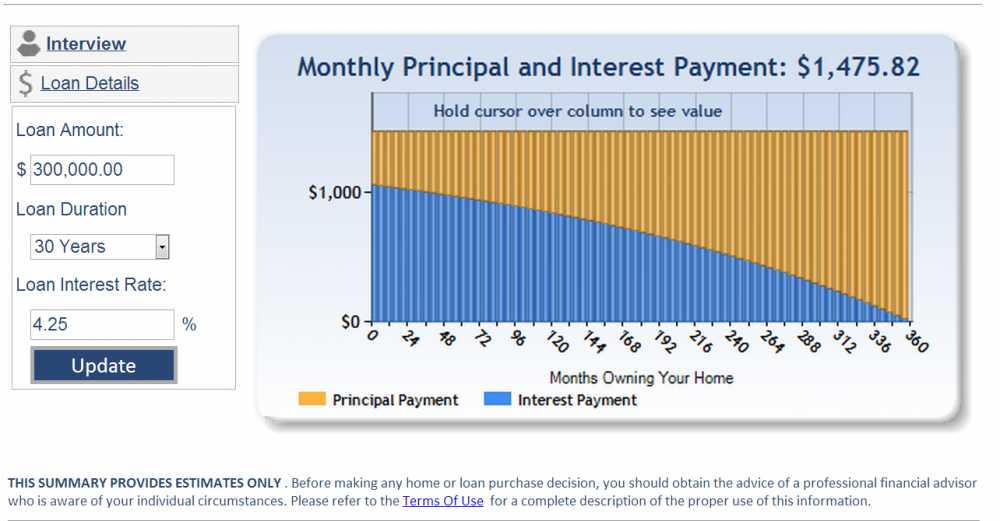

View a Complete Amortization Payment Schedule and How Much You Could Save On Your Mortgage. The tool is designed for taxpayers who were US. Having a neutral third partys opinions on your money management skills or lack.

Web If your annual mortgage interest paid for the home was 12000 you could deduct 4000 as an expense 12000 x 333 4000. Married taxpayers who are filing separate tax returns have a cap of. Web The interest you pay for your mortgage can be deducted from your taxes.

Web You can deduct home mortgage interest on the first 750000 375000 if married filing separately of indebtedness. Married filing jointly or qualifying widow er 25100. Web If your total property is rented out for the entire year you can deduct 100 of the mortgage interest paid on that property.

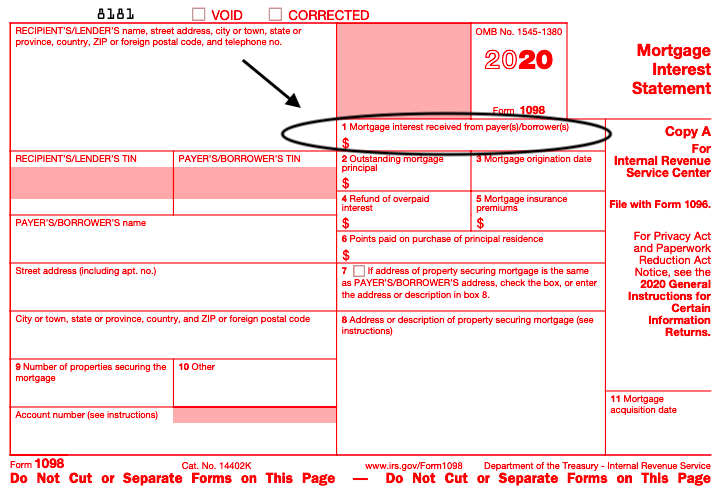

Web An estimated total if applicable of the amounts paid for mortgage interest points andor mortgage insurance premiums normally reported to you on Form 1098. Ad Developed by Lawyers. Mortgage insurance premiums.

Web 48 minutes agoAnnual repayments are now typically 12000 higher than they were in May 2022 following nine consecutive rate hikes. The limit is 375000 for married couples filing separate returns. Web You can claim the deduction every year that you make payments on your loan.

The write-off is limited to interest on up to 750000 375000 for married-filing-separately taxpayers of mortgage debt. LawDepot Has You Covered with a Wide Variety of Legal Documents. You can also deduct.

However higher limitations 1 million 500000 if married filing separately apply if you are deducting mortgage interest from indebtedness. Ad Increasing Mortgage Payments Could Help You Save on Interest. Mortgage points or prepaid interest paid at closing.

Web Reform caps the amount of mortgage debt for which you can claim an interest deduction at 750000.

Mortgage Interest Tax Deduction What You Need To Know

49 Best Small Business Ideas To Start In Patna In 2023

:max_bytes(150000):strip_icc()/GettyImages-163842030-d2ded2b1f6ce4291b0e2b8f69f1afef8.jpg)

Calculating The Home Mortgage Interest Deduction Hmid

Can I Write Off The Interest On My Rv Loan On My Taxes Blog Nuventure Cpa Llc

Eurock Com Music From Around The World Features Reviews Podcasts

49 Mobile App Ideas That Haven T Been Made 2023 Update

Mortgage Interest Deduction Can Be Complicated Here S What You Need To Know For The 2022 Tax Season The Seattle Times

Should I Pay Off My Mortgage Early Saverocity Finance

P5 Jpg

Mortgage Interest Deduction How It Calculate Tax Savings

49 Mobile App Ideas That Haven T Been Made 2023 Update

The Home Mortgage Interest Deduction Lendingtree

Free 49 Insurance Proposal Forms In Pdf Ms Word Excel

Mortgage Amortization Learn How Your Mortgage Is Paid Off Over Time

The Trucker Clogs In A Bad Way Direct From Denmark

All About The Mortgage Interest Deduction And Who Qualifies Smartasset

Kaiserslautern American May 29 2020 By Advantipro Gmbh Issuu